Living Wage Total Remuneration Assessment Methodology

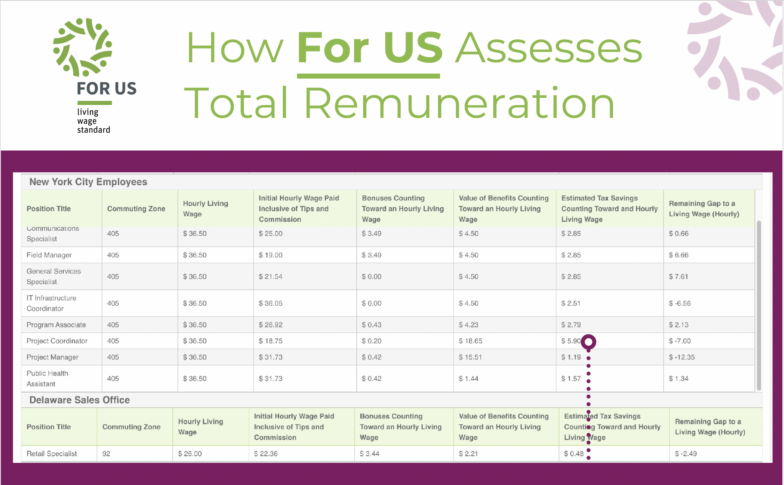

Paying a living wage can be more than just ensuring the base wage meets a living wage. Benefits matter. And good benefits can save workers a lot off the monthly expenses we included in living wage calculations. Please find attached our methodology for valuing total remuneration as credits toward living wage payment. All of this work aligns with three key principles:

1. Value of a benefit is examined from the lens of savings to worker. Not what an employer pays for this benefit. This means that an employer might pay more for health insurance provision than the savings a worker is actually receiving off what they would pay to access insurance on the open market. There are usually still savings with any generous health insurance plan provided by an employer, but they might not be as much as what the employer has to pay for the plan. This is because subsidies are available through the ACA marketplace that are not available for employers purchasing a group plan. But on the flip side, workers might benefit much more from a childcare reimbursement than employers actually spend on the benefit, as not all workers actually have this expense at any given time. Since we know exactly the cost we included in a living wage benchmark in each location across the US, we can value benefits against that cost. Looking at savings to worker and ensuring there is always enough remaining for basic decency and worker choice allows us to give employers a more holistic path to closing living wage gaps. One that is beneficial for workers and employers.

2. Only benefits that replace costs of living included in the living wage calculation can be counted toward a living wage. This means that some great benefits, like tuition reimbursement, cannot be valued toward a living wage. This is because we did not include college tuition costs in a living wage estimate. If we credited this, there would not be enough wages remaining to cover basics like food, housing, and transportation. But it also means that we can credit benefits that might not cost an employer anything to implement. For example, tax saving benefits like Medical, Transportation, or Dependent Care FSA plans, even if an employer is not making contributions, can be credited against the living wage for the tax savings they offer. It’s a very precise way of measuring total remuneration value for all workers. See our standard guidance for a listing of benefits that do and do not count toward living wage payment following this principle.

3. Bonuses can count toward living wage payment, but only if the bonus is expected and can be relied upon by the worker. This means that performance bonuses that are variably awarded to only some employees would not count toward a living wage. But annual bonuses and even variable profit sharing bonuses can be accounted for against a living wage. We simply examine the history of the benefit for the past 3 years and credit the amount that workers can depend on receiving and would be able to budget.

4. Tips and commissions can also be credited toward living wage payment as long as the amount necessary to reach a living wage is guaranteed by the employer.