Living Wage Total Remuneration Assessment Methodology

Paying a living wage can be more than just ensuring the base wage meets a living wage. Benefits matter. And good benefits can save workers a lot off the monthly expenses we included in living wage calculations. Please find attached our methodology for valuing total remuneration as credits toward living wage payment. All of this work aligns with three key principles:

- Value of a benefit is examined from the lens of savings to worker.

- Only benefits that replace costs of living included in the living wage calculation can be counted toward a living wage.

- Caps are applied to benefits that severely limit worker choice e.g. if an employer supplies, housing, meals, transport, etc. to the point where a worker cannot afford any choice in how they live their life, those benefits may be limited as an overall group. Health insurance provision is not an example of limited worker choice because workers can still chose doctors, etc.

- Bonuses can count toward living wage payment, but only if the bonus is expected and can be relied upon by the worker.

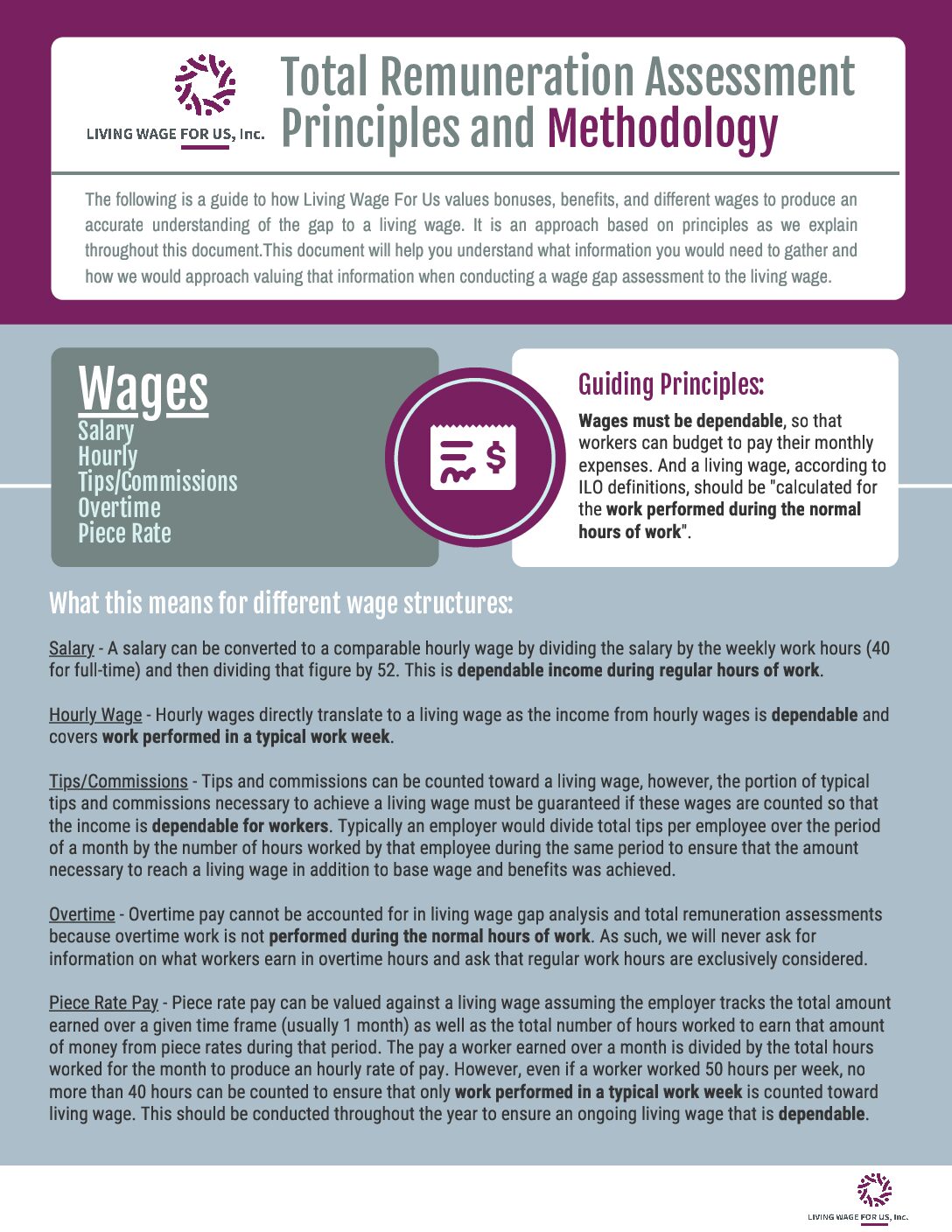

- Tips and commissions can also be credited toward living wage payment as long as the amount necessary to reach a living wage is guaranteed by the employer.